Welcome to wikilifestyles.com

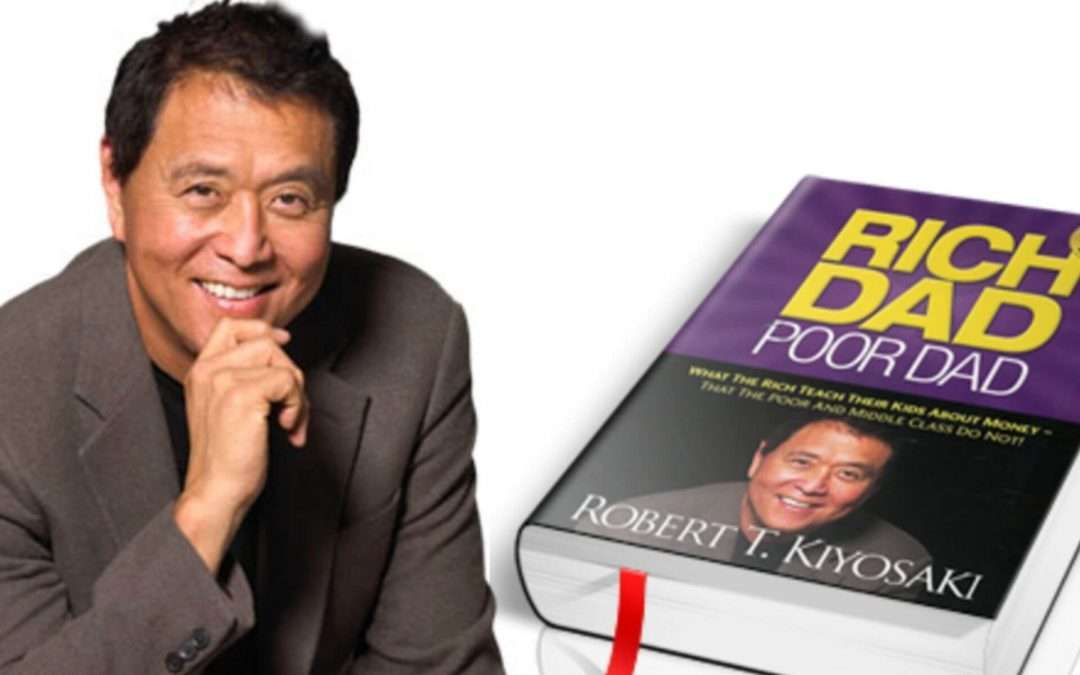

Introduction: 10 Lessons from Robert Kiyosaki’s book Rich Dad Poor Dad

Hello, my intelligent pals! Today, we’re going to discuss 10 lessons from Robert Kiyosaki’s book Rich Dad Poor Dad, this article will give you some insights and lessons that will make you knowledgeable about generating alternative income, and if you’re looking for advice on how to become rich quickly, You’ve come to the wrong spot. so fasten your seatbelt and get set to take away 10 important lessons from this financial classic. You won’t be subjected to endless graphs and charts, we guarantee – unless they’re amusing ones, of course. So let’s get started and discover how to enjoy ourselves while being financially prudent

1. The Poor and Middle-class work for Money; The Rich have Money Work for them:

If you’re like most people, you probably believe that the key to financial success is to work harder and earn more money. What if we told you that the real key to becoming wealthy is to stop working so hard and start working smarter? That’s right, according to Robert Kiyosaki’s “Rich Dad, Poor Dad,” the rich understand that the key to accumulating wealth isn’t just making more money – it’s making your money work for you.

Consider this: if you’re constantly exchanging your time for money, you’ll never truly achieve financial freedom. You may be able to make a good living, but you will always be constrained by the number of hours in a day. The rich, on the other hand, recognize that the key to financial success is to intelligently leverage their money so that it can continue to work for them even when they are not actively working.

So, how can you begin to work smarter rather than harder? One of the most effective methods is to begin wisely investing your money. Whether it’s through stocks, real estate, or another type of investment, the key is to put your money to work for you rather than just leaving it in a savings account earning nothing.

2.The Single Most Powerful Asset we all have is our Mind if it is trained well it can create Enormous Wealth:

Do you want to be rich? You, of course, do! And do you know what your single most powerful asset is for making that happen? Your mind! That’s correct. If you properly train your mind, it can generate enormous wealth for you. Do you still not believe us? So, let’s look at the lesson from “Rich Dad, Poor Dad” and see how a well-trained mind can make all the difference.

Lesson #1: Mind Your Own Business

You must mind your own business if you want to become rich. And what better way to do so than to train your mind to focus on what is important? A well-trained mind knows how to prioritize and eliminate distractions, allowing you to focus on your business and grow it.

Lesson #2: Run that risk

Getting rich necessitates risk-taking, and a well-trained mind is not afraid of failure. Instead, it views failure as a chance to learn and grow. So, if you want to be rich, begin by conditioning your mind to be resilient and adaptable.

Lesson #3: Analyze with the Best

People who are successful are successful for a reason, and if you want to get rich, you must learn from the best. A well-trained mind is constantly seeking new knowledge and skills, allowing you to seize opportunities as they arise.

Lesson #4 Surround Yourself with Success

You must surround yourself with successful people if you want to become rich. A well-trained mind understands how to network and form relationships with people who can assist you in achieving your objectives.

3. It’s not how much money you make it’s how much money you keep:

Congratulations on securing your dream job with a six-figure salary! You must be feeling pretty good about yourself, don’t you? Don’t get too excited, though. It’s not about how much money you make, as Rich Dad Poor Dad author Robert Kiyosaki points out, but about how much money you keep.

Sure, a high salary is nice, but if you spend the same (or more) than you earn, you’re not really getting ahead. In fact, you might be falling further behind. So, what can you do to keep more of your hard-earned money?

First, examine your spending habits. Are you overspending on things you don’t really need just because you can? It’s time to start being more selective with your purchases. Do you really need that designer handbag, or can you get by with something less expensive? Is it necessary to eat out at upscale restaurants every week, or can you cook at home more frequently?

Start thinking about ways to diversify your income streams next. This does not necessarily imply taking on a second job (although that could be an option). It could be as simple as selling items you no longer need or starting a side hustle in which you are interested.

Finally, think about investing your money wisely. Rather than leaving it in a savings account earning a modest interest, consider stocks, mutual funds, or other investment opportunities that have the potential to grow your wealth over time, Nowadays its pretty easy to open an demat account ,its just within some clicks on mobile

Remember, it’s not how much money you make that matters; it’s how much money you keep. Begin by being more conscious of your spending, looking for ways to increase your income, and investing wisely. Your future self will appreciate it, as will your bank account!

4.The Rich focus on their asset columns while everyone else focuses on their income statements:

Do you constantly check your bank account, obsessing over every penny you earn? You might be focusing on the wrong thing, according to Rich Dad Poor Dad author Robert Kiyosaki.

The rich, according to Kiyosaki, focus on their asset columns – the things that generate income for them, such as real estate, stocks, and businesses – while the rest of us focus on our income statements.

So, how does this affect you? So it might be time to start thinking about how you can create your own asset columns. You may have a steady job that pays the bills, but if you’re not accumulating assets that generate passive income, you’re passing up an important opportunity to increase your wealth.

Perhaps you’ve always wanted to invest in real estate but don’t know where to begin. Or maybe you have a great business idea but aren’t sure how to get it started. Whatever your goal, it’s critical to get started on building your asset columns right away.

Of course, this does not mean you should ignore your income statement entirely. You must still ensure that you are earning enough to cover your expenses and contribute to your asset-building goals. However, shifting your focus to your asset columns will help you build long-term wealth and financial security.

So, the next time you find yourself obsessing over your paycheck or monthly expenses, remember that the rich focus on their asset columns, while everyone else focuses on their income statements. It’s time to start thinking like the rich and creating your own passive income streams. Who knows, maybe one day you’ll be checking your bank account and laughing all the way there!

5.Often in the real world it’s not the smart who get ahead but the bold:

You might believe that being the smartest person in the room is the only way to achieve success in the real world. However, Rich Dad Poor Dad author Robert Kiyosaki claims that this is not always the case. In fact, the brave are often the ones who succeed.

True, being smart can help you get ahead. However, if you are unwilling to take risks and put yourself out there, you may not make it very far. Consider this: some of the world’s most successful people got to where they are today by taking bold steps and making big moves. Mr. M.A.Yusuff Ali is one the living examples. Visit this link to learn more about his journey toward achievement.

Maybe you’ve been putting off starting your own business because you’re not sure you’re ready. Or maybe you’ve been putting off asking for the raise you know you deserve. Whatever it is, it is time to get bold.

Of course, this does not mean you should ignore caution and make rash decisions. You must still exercise caution when making decisions and weigh the risks and benefits. However, by taking calculated risks and being willing to step outside your comfort zone, you will increase your chances of success.

Don’t be afraid to be bold, whether it’s starting your own business, or pursuing a new opportunity. Remember that in the real world, it is often bold who succeeds rather than smart.

6.It’s not gambling if you know what are you doing, It’s gambling if you are just throwing money into a deal and praying:

“It’s not gambling if you know what you’re doing; it’s gambling if you’re just throwing money into a deal and praying,” as the saying goes. But let’s be honest: even if you do know what you’re doing, there’s still an element of risk involved. And, after all, what is life without a little danger?

Investing in the stock market, real estate, or starting your own business can be intimidating, but it is not as frightening as you may believe. Sure, you could lose your money, but there’s also a chance you could make a lot of money. And if you’re careful, you can improve your chances of success,

Rakesh Juhunjhunwala’s life story will inspire anyone considering investing in the stock market; he began investing while still in college. Jhunjhunwala’s first big profit came in the form of 5 lakh in 1986, after starting with 5,000 in 1985. He made nearly 20-25 lakh profit between 1986 and 1989. His investment had grown to 11,000 crores by 2022. His largest investment as of 2021 was in Titan Company, which was worth 7,294.8 crore.

The key is to conduct research, develop a strategy, and stick to it. Don’t put your money into the latest hot stock or real estate deal unless you know what you’re doing. Learn about the market, the industry, and the company or property you’re thinking about investing in.

And keep in mind that investing does not have to be boring. It’s exciting to see your money grow and the fruits of your labor pay off. So go ahead, take a chance, and enjoy yourself. Just make sure you do it correctly.

7.The Primary difference between a rich person and a poor person is how they manage fear:

We all experience fear, but how we deal with it distinguishes us. The rich manage their fears like bosses, whereas the poor allow fear to manage them.

Fear can be a powerful emotion when it comes to money. Fear of not having enough, fear of losing what you have, and fear of making a mistake are all common concerns that can prevent us from achieving financial success.

The rich, on the other hand, recognize that fear is merely an emotion and do not allow it to control them. They use fear to motivate themselves to take action, make wise investments, and learn from their mistakes.

The poor, on the other hand, are paralyzed by fear. They are afraid to take risks, invest, and make mistakes. They remain in their comfort zone, never attempting to grow or improve.

So, how do you deal with your fears like a boss? The key is to educate yourself, plan ahead of time, and take action. Don’t let fear prevent you from reaching your financial objectives.

Educate yourself on the markets, the industry, and the available investment opportunities .Read magazines constantly related to market, Make a plan that is in line with your financial objectives and stick to it. Finally, and most importantly, take action. Don’t wait for the perfect moment, because it may never come. The perfect moment is now.

8.Failure Inspires winners. Failures defeat loser:

The truth is that everyone fails at some point in their lives. The winners, on the other hand, use failure as a springboard to success. They learn from their mistakes, modify their strategy, and keep moving forward.

Losers, on the other hand, are defeated by failure. They abandon ship, place blame on others, or simply refuse to try again.

Lets take the life history of Mr Dhirubhai Ambani , an Indian industrialist who founded Reliance Industries, a massive petrochemicals, communications, power, and textile conglomerate that was India’s largest exporter and the first privately owned Indian company to make the Fortune 500 list.

Ambani was the third of five children born to a village schoolteacher and his wife, and he was raised in a low-income family. He moved to the British colony of Aden at the age of 17 to join his brother. He began his career as a clerk at A. Besse & Co., the largest transcontinental trading firm east of Suez in the 1950s. He learned trading, accounting, and other business skills while there. Ambani returned to India in 1958 and settled in Bombay (now Mumbai).

In the late 1950s, Ambani started a spice trading company called Reliance Commercial Corporation. He quickly expanded into other commodities, employing a strategy of providing higher-quality goods while accepting lower profits than his competitors. His company expanded quickly. Ambani turned to synthetic textiles after deciding that the corporation had gone as far as it could with commodities. In 1966, he made his first foray into backward integration by opening the first Reliance textile mill. He gradually shaped Reliance into a petrochemicals behemoth, later adding plastics and power generation to the company’s businesses, continuing a policy of backward integration and diversification. click this link to read more

So, how do you make failure your friend? The first step is to shift your perspective. Instead of viewing failure as a negative, consider it a chance to learn and grow. Use it as a tool to help you improve, not as a hindrance.

The second step is to examine your mistakes. Examine what went wrong and consider what you could have done differently. Use this information to modify your approach and make improvements for the next time. Don’t be afraid to give it another shot. Failure can be crippling, but it’s important to remember that it’s not the end. It’s just a temporary hiccup on the road to success.

Finally, failure can be your friend if you learn from it. Accept failure as a chance to learn and grow, analyze your errors, and don’t let fear hold you back. Remember that failure inspires winners while defeating losers. So, be a winner and keep moving forward toward your objectives.

9.For most people, the reason they don’t win financially is that the pain of losing money is far greater than the joy of being rich:

Let’s face it: losing money is painful. And for most people, the fear of losing money outweighs the desire to become rich. But the truth is that if you want to win financially, you must accept the risk.

Pessimism is a natural emotion, but it can prevent you from making sound financial decisions. It can prevent you from taking risks, investing in opportunities, or pursuing your financial objectives.

The key to financial success is to change your mindset. Instead of focusing on the possibility of losing money, consider the potential rewards. Consider the satisfaction of financial independence, the security of a comfortable retirement, and the ability to provide for your loved ones.

The truth is that no one ever became rich without taking risks. To achieve their financial goals, every successful entrepreneur, investor, and business owner has had to embrace risk.

So, how do you embrace risk? Begin by educating yourself on the markets, the industry, and the available investment opportunities. Create a strategy that is in line with your financial objectives and risk tolerance. Finally, do something. Don’t let fear prevent you from pursuing your financial goals.

10.Rich people acquire assets. The poor and middle class acquire liabilities that they think are assets:

When it comes to wealth accumulation, it’s critical to understand the distinction between assets and liabilities. The rich acquire assets, whereas the poor and middle classes acquire liabilities that they mistake for assets.

So, exactly what is an asset? An asset is something that allows you to make money. It either generates income or increases in value. Real estate, stocks, and businesses are examples of assets.

A liability, on the other hand, is something that costs you money. It necessitates payments and neither generates income nor grows in value. Cars, credit card debt, and expensive vacations are examples of liabilities.

The issue is that many people mix up liabilities and assets. They believe that having a flashy car, a large house, or the latest gadget is an asset when, in reality, it is a liability that drains their finances.

To accumulate wealth, it is critical to focus on acquiring real assets that generate income and increase in value over time. This includes investing in properties, stocks, and businesses that have the potential to provide long-term financial benefits.

Don’t be duped by sham assets. Learn to distinguish between assets and liabilities and concentrate on acquiring the former. It is essential for long-term wealth and financial security.

Conclusion:10 Lessons from Robert Kiyosaki’s book Rich Dad Poor Dad

Finally, Robert Kiyosaki’s “Rich Dad, Poor Dad” is an insightful book that teaches valuable lessons on financial success. Individuals can learn how to shift their mindset, build wealth, and achieve financial security by following the ten lessons outlined in the book.

The lessons in this book are essential for anyone who wants to achieve financial success, from understanding the difference between assets and liabilities to embracing risk and focusing on asset building. You can make better financial decisions, build long-term wealth, and secure your financial future by applying these lessons in your daily life.

Remember that financial success involves not only earning more money but also managing it wisely. Anyone can achieve financial success and a better life for themselves and their loved ones with the right mindset, education, and discipline.

So, take the lessons from “Rich Dad Poor Dad” to heart, and start building the foundation for your financial success today. With dedication, persistence, and a willingness to learn, you can achieve your financial goals and live the life you’ve always dreamed of.

FAQ:

Q: What is Rich Dad Poor Dad actually about?

Rich Dad Poor Dad is a book written by Robert Kiyosaki that provides lessons and insights on personal finance, investing, and building wealth. The book contrasts the financial beliefs and practices of two fathers – the author’s own “poor” dad and his friend’s “rich” dad.

Q: What are some of the key lessons from Rich Dad Poor Dad which we can apply?

Some of the key lessons from the book include the importance of financial education, the difference between assets and liabilities, the power of passive income, and the benefits of taking calculated risks.

Q: What is the difference between an asset and a liability in an ordinary language?

An asset is something that puts money in your pocket, while a liability is something that takes money out of your pocket. Examples of assets include rental properties, stocks, and businesses, while liabilities include things like car payments and credit card debt.

Q: How can I start building passive income?

Passive income can be generated through a variety of sources, such as rental properties, dividend-paying stocks, and online businesses. The key is to find a source of passive income that aligns with your skills and interests and requires minimal ongoing effort.

Q: What are some common misconceptions about wealth building?

Some common misconceptions about wealth building include the belief that you need a high income to build wealth, that investing is only for the wealthy, and that taking risks is always a bad idea.

Q: How can I develop a mindset of wealth building?

Developing a mindset of wealth building requires a shift in perspective and an emphasis on long-term thinking. It involves understanding the difference between assets and liabilities, seeking out financial education, and focusing on creating passive income streams.

Q: Is that possible for anyone to build wealth, regardless of their income level?

Yes, anyone can build wealth, regardless of their income level. It requires discipline, persistence, and a willingness to learn and take calculated risks.

Q: What is the importance of financial education in today’s Era?

Financial education is important because it provides the knowledge and skills necessary to make informed financial decisions. It can help you understand the difference between good and bad debt, identify investment opportunities, and avoid common financial pitfalls.

Q: What are some common mistakes that people make when it comes to personal finance management?

Some common mistakes include living beyond one’s means, failing to save for emergencies, and focusing too much on short-term gains rather than long-term wealth building.

Q: How can we apply the lessons from Rich Dad Poor Dad to my own life?

The lessons from Rich Dad Poor Dad can be applied by focusing on developing a mindset of wealth building, seeking out financial education, and taking action to create passive income streams. By adopting these principles and practices, anyone can build wealth and achieve financial freedom.